EduUnited.org

Tax

200211-10-Q12

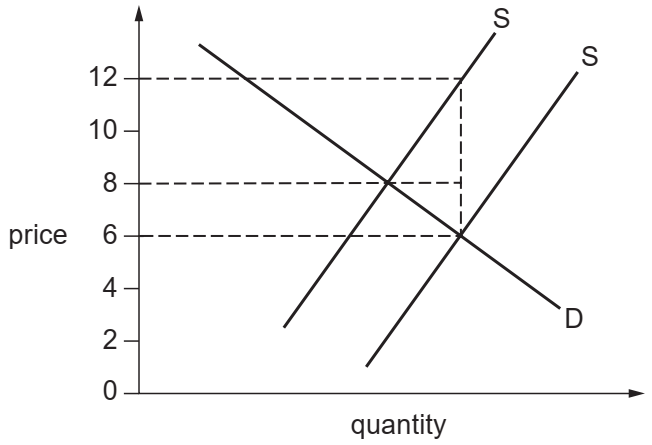

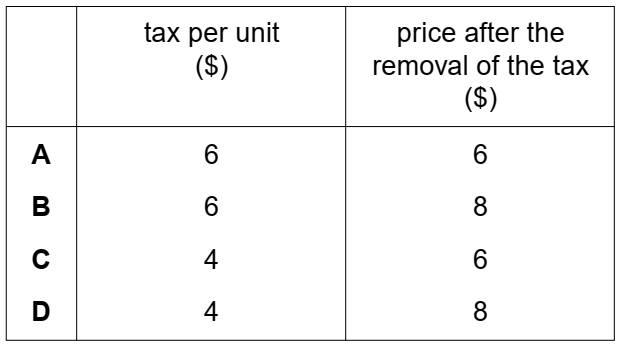

The diagram shows the demand and supply curves of a commodity before and after a specific tax is removed.

What was the tax per unit of output and what is the price after the removal of the tax?

答案:

分析Analysis

- Specific tax increases per unit cost of production by the size of tax, so it shifts the supply curve up by the same amount. Thus removing it causes the supply curve to shift downward by the size of tax, i.e. the tax per unit is $6(=12-6)

间接税增加的每件生产成本等于税的大小,这样供给曲线上升的大小等于税的大小。所以将税移除造成供给曲线下降税的大小,也就是每个的税为6美元。

- The equilibrium price drop from $8 to $6. (The reason why the price change is smaller than the size of tax is because the tax burden was shared between sellers and buyers.)

均衡价格从8美元下降到6美元。(价格变化小于税的大小的原因是之前有税的时候税收的负担是由卖家和买家共同承担的.)

领取免费学习资料

提交电子邮件领取免费Alevel经济学资料(其他问题请留言)

Please submit your e-mail to obain a free copy of Alevel Economics notes.

联系我们CONTACT US